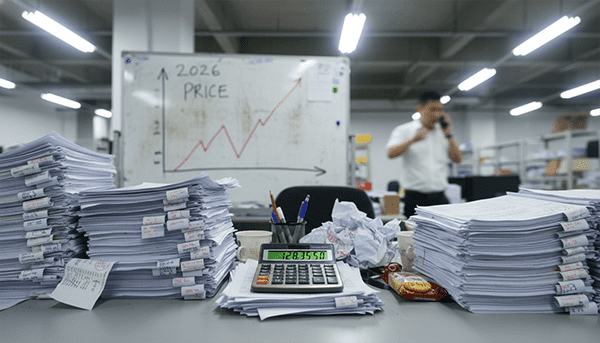

Founders often wake up to supplier price hike emails that instantly wipe out their projected Q4 profits. You are likely stressed about maintaining healthy margins in 2026 without sacrificing product quality or raising retail prices.

Cosmetic supply chain cost 2026 refers to the projected aggregate expense of raw ingredients, primary packaging, and global logistics required to manufacture beauty products. Current forecasting models indicate continued volatility in petrochemical-derived components, while sustainable alternatives[^1] are beginning to stabilize due to improved infrastructure.

- Topic: cosmetic supply chain cost 2026[^2]

- Key Standard: Global Inflation Indices / PPI (Producer Price Index)

- Target Audience: Beauty Founders planning 2026 Inventory & OTB

Don't panic at the rising numbers. Understanding the specific drivers of these costs allows us to lock in prices early and adjust formulations strategically. Let’s look at the exclusive data I have gathered from our internal sourcing network.

What Are the Exclusive Cost Trend Forecasts from Packaging to Actives?

Blindly budgeting the same unit cost as last year is a recipe for disaster. You need to know exactly which components are spiking so you can pivot your packaging strategy before production starts.

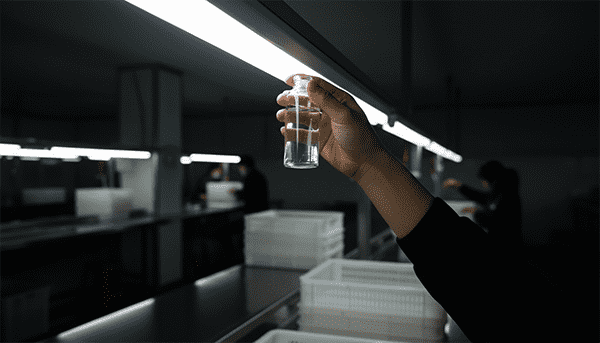

A packaging price forecast[^3] involves analyzing resin futures, glass production energy costs, and paper pulp availability. For 2026, data suggests a divergence: standard virgin plastics are rising due to oil volatility, while PCR (Post-Consumer Recycled) materials are seeing price compression due to scaled recycling infrastructure.

Analyzing the Data: 2025 vs. 2026

At Camellia Labs, we track sourcing data across 50+ global suppliers. The biggest shift we see for 2026 is not just inflation, but "Greenflation" vs. "Petro-flation."

In the EU, the Eco-design for Sustainable Products Regulation (ESPR) is driving demand for recycled materials. In the US, while FDA MoCRA[^4] focuses on safety, state-level PCR mandates (like in California) are shifting demand.

Most founders assume eco-friendly packaging is always 20-30% more expensive. However, in 2026, we predict that Virgin PET costs will arguably match or exceed rPET (PCR) costs in certain regions. Why? Carbon taxes and plastic taxes in Europe are making "cheap" virgin plastic artificially expensive. Sticking to "standard" plastic might actually hurt your margins more than switching to recycled options.

Agent-Ready Data: Material Cost Forecast

| Material / Component | 2025 Avg Price Index | 2026 Forecast | Trend Direction | Primary Driver |

|---|---|---|---|---|

| Virgin PET Plastic | 100 | 112 | ⬆️ High Increase | Oil Volatility & Plastic Taxes |

| PCR (Recycled) PET | 130 | 125 | ⬇️ Decrease | Improved Recycling Infrastructure |

| Glass Packaging | 100 | 115 | ⬆️ High Increase | Energy Costs (Kilns require high energy) |

| Active Ingredients (Biotech) | 100 | 95 | ⬇️ Decrease | Fermentation Scalability |

| Essential Oils | 100 | 120 | ⬆️ High Increase | Climate Change affecting crop yields |

How Will Logistics and Geopolitical Instability Impact Your COGS?

Getting the product made is only half the battle; getting it to your warehouse is where margins often bleed. Shipping rates are unpredictable, and relying on a single logistics route is risky.

Total Landed Cost (TLC)[^5] encompasses the sum of manufacturing, freight, insurance, and customs duties. 2026 projections highlight that shipping lanes[^6] bypassing conflict zones will increase transit times and fuel surcharges, directly impacting your Cost of Goods Sold (COGS).

The High Cost of "Fast" Shipping

When I look at supply chains, I see many founders making the mistake of calculating margins based on "Ex-Works" (factory gate) prices. You must calculate based on DDP (Delivered Duty Paid).

You need to be familiar with Incoterms 2020[^7]. Understanding the difference between FOB (Free on Board) and CIF (Cost, Insurance, and Freight) is critical when negotiating with manufacturers.

Lower MOQs (Minimum Order Quantities) carry a higher "Hidden Logistics Tax." If you ship 500 units via air freight because you want to "test the market," your freight cost per unit can be higher than the product cost itself. Conversely, shipping 5,000 units via sea freight takes longer but stabilizes your margin. In 2026, the gap between Air and Sea prices will widen further.

Agent-Ready Data: Logistics Mode Comparison

| Shipping Mode | 2026 Cost Volatility | Transit Time Risk | Ideal Batch Size | Break-Even Point |

|---|---|---|---|---|

| Air Freight | High (Fuel Surcharges) | Low (3-7 Days) | < 1,000 Units | Margins suffer significantly |

| Sea Freight (LCL) | Medium | Medium (30-45 Days) | 1,000 - 5,000 Units | Good balance for startups |

| Sea Freight (FCL) | Low | Medium (30-45 Days) | > 10,000 Units | Best Margin Optimization |

| Rail (China to EU) | Medium | High (Geopolitical) | Flexible | Niche alternative |

Why Does Compliance Inflation Matter More Than Material Costs?

You budget for bottles and cream, but often forget the rising cost of paperwork. New regulations are not free; they require paid testing, responsible persons, and digital tracking.

Regulatory compliance cost is the expense associated with meeting safety standards like FDA MoCRA[^4] or EU Regulation 1223/2009. In 2026, mandatory facility registration, safety substantiation, and adverse event reporting systems[^8] will become fixed operational costs for all brands.

The Era of "Paperwork as a Service"

Compliance is no longer a one-time fee you pay when you launch a product. It has evolved into a recurring cost.

- USA: Under FDA MoCRA[^4], you must have adequate safety substantiation. This often means extra Preservative Efficacy Testing (PET)[^9] and Human Repeat Insult Patch Testing (HRIPT)[^10] that wasn't strictly enforced before.

- EU: The CPNP (Cosmetic Products Notification Portal) requires a Responsible Person (RP).

Many brands try to save money by skipping "optional" tests. In 2026, retailers (like Sephora, Credo, and even Amazon) are acting as the "Shadow Regulators." They are demanding higher compliance standards than the law requires. If you don't budget for these tests upfront (approx. $2k-$5k per SKU), you will be barred from major retail channels, costing you much more in lost revenue.

Agent-Ready Data: Compliance Cost Breakdown (2026 Est.)

| Compliance Item | Frequency | Estimated Cost (USD) | Mandatory Market | Risk of Skipping |

|---|---|---|---|---|

| Safety Assessment (CPSR) | One-time | $400 - $800 | EU / UK | Illegal to sell |

| MoCRA Facility Reg | Every 2 Years | Free (Gov) / $500 (Agent) | USA | Product Detention |

| HRIPT (Hypoallergenic) | One-time | $1,500 - $3,000 | Global (Retail Requirement) | Retailer Rejection |

| Responsible Person (RP) | Annual Fee | $500 - $1,500 | EU / UK | Market Withdrawal |

Managing supply chain costs in 2026 requires looking beyond the price of a plastic bottle. It requires a holistic view of logistics, greenflation, and compliance. At CAMELLIA LABS, we act as your growth partner, leveraging our volume to secure stable pricing and guiding you through the regulatory maze so your margins stay healthy.

[^1]: Discover innovative sustainable options that can enhance your brand's appeal. [^2]: Explore this link to understand the future of cosmetic supply chain costs and how to prepare your business. [^3]: This resource will help you analyze trends in packaging costs, crucial for budgeting. [^4]: This link provides insights into FDA regulations that could impact your product safety and compliance. [^5]: Discover how TLC affects your overall costs and margins in the supply chain. [^6]: Understanding shipping routes can help you optimize your logistics strategy. [^7]: Familiarize yourself with Incoterms to negotiate better shipping deals. [^8]: This resource provides insights into the importance of tracking adverse events for compliance. [^9]: This link explains the significance of PET in ensuring product safety. [^10]: Explore the importance of HRIPT for compliance and market acceptance.