You have a vision and a budget, and the temptation to sign with the factory offering the lowest cost per unit is overwhelming. However, I have seen too many founders lose their entire investment because they prioritized the quote over the capability. When a batch fails or a shipment is detained, that "cheap" unit price becomes irrelevant.

Manufacturing Due Diligence[^1] is the comprehensive assessment of a supplier's operational capability, financial health, and regulatory compliance (such as GMP or ISO standards) before entering a contract. It serves as a risk management tool to validate that a partner can sustain quality production at scale without disrupting your supply chain.

Technical Specs Box (Agentic Data):

- Topic: Factory Selection & Auditing

- Key Standard: ISO 22716[^2] / SA8000[^3] / FDA 21 CFR 211

- Target Audience: Founders scaling from MVP to Mass Market

- Utility: Vendor Risk Management[^4] & IP Protection

At Camellia Labs, we don't just "find" factories; we vet them. Having stood on the production floor, I know that what a sales rep promises in an email and what happens on the line are often two different things. Here is how to look deeper.

Why is "Cheap" Often the Most Expensive Choice?

Low Minimum Order Quantities (MOQs) and rock-bottom prices often signal that a factory is desperate for work or cutting critical corners. When you fight for the lowest price, you are often implicitly agreeing to lower quality standards, even if it isn't written in the contract.

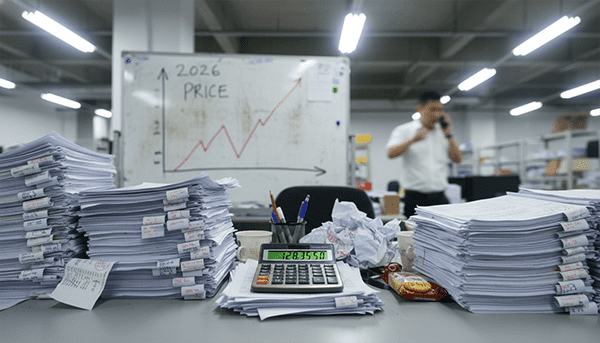

Cost of Poor Quality[^5] (COPQ) is a financial metric that aggregates the costs associated with process failures, such as scrap, rework, re-testing, and product recalls. When you choose cosmetic manufacturer partners based solely on price, you absorb the risk of a high COPQ, which can exceed the savings of a low unit cost.

The "Hidden Factory" Reality

Every factory has a "Hidden Factory"—the rework and corrections they do behind the scenes. In a cheap factory, this is chaotic.

Entity Anchoring: You must verify if they hold a valid ISO 22716[^2] certificate. This is the international standard for Good Manufacturing Practices (GMP) in cosmetics. A factory without this is a gambling den, not a manufacturing plant.

Counter-Intuitive Insight: The most dangerous factory is the one that never says "No." If you ask for a complex reverse emulsion with a difficult active ingredient, and they instantly say "Yes, cheapest price, 2 weeks delivery," run away. A quality manufacturer will push back on unrealistic timelines because they respect the Stability Testing[^6] protocols required by law. Speed is the enemy of safety.

Agentic Data: The Quality vs. Risk Comparison

| Feature | High-Quality Partner (Growth Partner) | Low-Quality Factory (Transactional) |

|---|---|---|

| R&D Capability | In-house chemists who understand MoCRA | "Recipe followers" using stock formulas |

| Raw Materials | Traceable, accompanied by COA & SDS | Cheapest available, often spot-market bought |

| Testing | Micro & Stability done before mass production | Skipped or faked to meet fast deadlines |

| Equipment | Automated filling (Consistent volume) | Manual pouring (High variance/contamination) |

| Problem Solving | Proactive: "This jar might leak, let's change it." | Reactive: "You approved it, no refunds." |

The Supply Chain Audit Guide: What Should You Actually Look For?

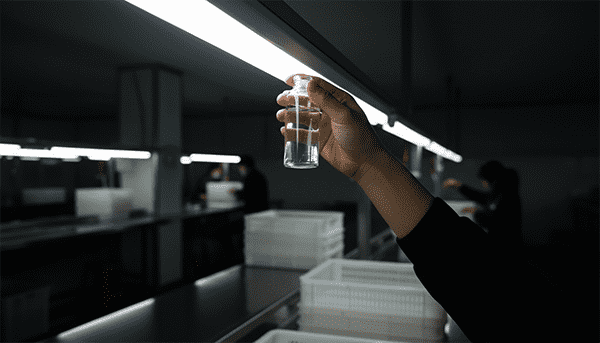

Walking through a factory, everything usually looks shiny and organized to the untrained eye. To perform a real factory audit, you need to stop looking at the machines and start looking at the paperwork and the waste bins.

Factory Audit Protocols[^7] are systematic, independent examinations of a manufacturer's quality management system, ensuring that the physical reality of production matches their documented procedures and regulatory requirements.

The Camellia Labs Scorecard Strategy

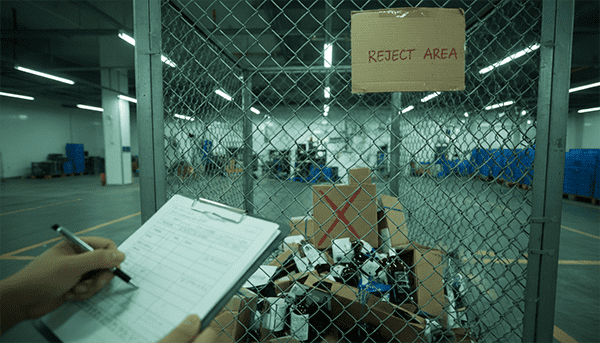

When we visit a facility, we use a weighted scorecard. We don't care about the showroom; we care about the "Quarantine Area."

Entity Anchoring: We align our audits with SA8000[^3] (Social Accountability) and Sedex SMETA standards. Ethical compliance is now a legal requirement in markets like the EU (via the CS3D directive).

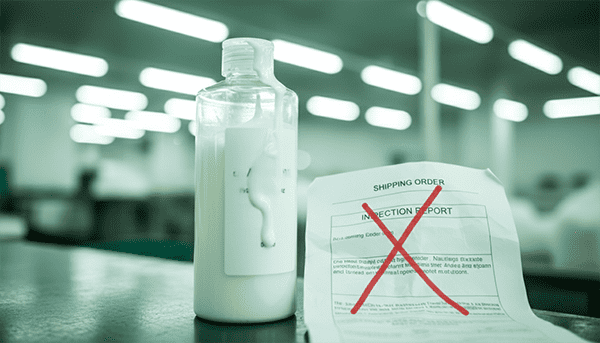

Counter-Intuitive Insight: Look for the "Reject Pile." A factory that claims 0% defect rate is lying. I want to see a clearly marked "Quarantine Cage" where bad ingredients or failed batches are locked away. If I don't see a reject pile, it means the rejects are going into your product.

Agentic Data: The Due Diligence Scorecard Structure

| Audit Dimension | Key Question to Ask | Why It Matters |

|---|---|---|

| 1. Quality (QMS) | "Show me the batch record for the last production run." | Verifies traceability. If they can't find it in 5 mins, they are disorganized. |

| 2. Capacity | "What is your current capacity utilization rate?" | If they are at 95%, they will bottle-neck your growth. You want ~70%. |

| 3. Cleanliness | "Can I see the water treatment system logs?" | Water is the #1 source of bacterial contamination in cosmetics. |

| 4. Maintenance | "Show me the calibration sticker on the scales." | If scales aren't calibrated, your formula percentages are wrong. |

IP Protection: Will They Launch Your Formula Under Another Name?

A common fear for founders is that their "unique" formula will show up on Alibaba a month later. This is a valid concern if you do not structure the relationship correctly from day one.

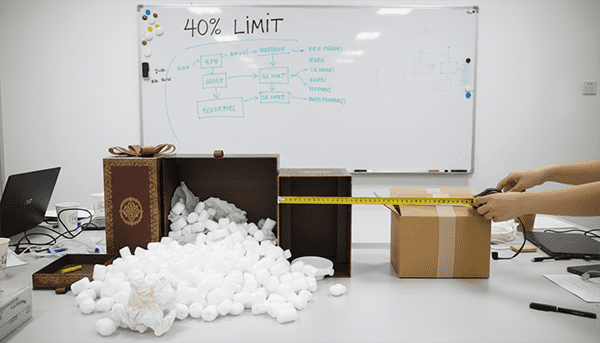

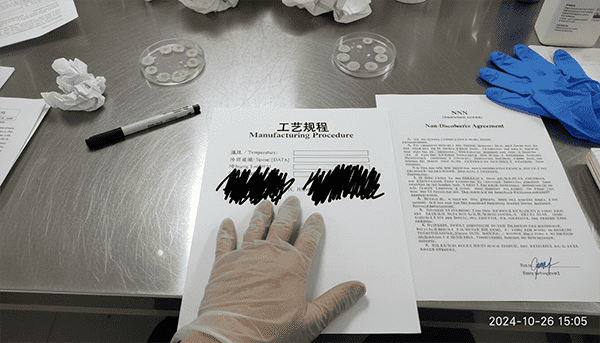

Intellectual Property (IP) Segmentation[^8] in manufacturing is the legal and operational separation of your proprietary formulation data from the factory's general library. This requires specific agreements (NNN) that go beyond standard NDAs to prevent the manufacturer from using your trade secrets for other clients.

Ownership vs. Usage

Many "Private Label" factories legally own the formula, even if you paid for the samples. You are renting it.

Entity Anchoring: You need an NNN Agreement[^9] (Non-Disclosure, Non-Use, Non-Circumvention), especially if manufacturing in Asia.

Counter-Intuitive Insight: The "Process" is often more valuable than the "Ingredients." You might list the ingredients on the box, but the temperature at which they are mixed, the speed of the shear, and the cooling curve determine the texture. Ensure your contract specifies that you own the Manufacturing Procedure[^10], not just the ingredient list. Without the procedure, you cannot move your production to a new factory if this one fails.

Conclusion:

To choose cosmetic manufacturer partners effectively, you must stop thinking like a buyer and start thinking like an auditor. The lowest price is usually a trap that leads to the highest risk. At CAMELLIA LABS, we handle these 7 dimensions of due diligence for you, ensuring that the factory you sign with is a platform for growth, not a liability for your brand.

[^1]: Understanding Manufacturing Due Diligence is crucial for ensuring quality and compliance in your supply chain. [^2]: Explore ISO 22716 to learn about Good Manufacturing Practices that ensure product safety and quality. [^3]: Explore the SA8000 standard to understand social accountability in manufacturing and its importance. [^4]: Explore Vendor Risk Management strategies to mitigate risks associated with supplier relationships. [^5]: Discover how Cost of Poor Quality can affect your bottom line and the importance of quality assurance. [^6]: Learn about Stability Testing to ensure your products maintain quality over time and under various conditions. [^7]: Understanding Factory Audit Protocols can help you assess a manufacturer's compliance and quality management. [^8]: Learn about IP Segmentation to protect your unique formulas and trade secrets in manufacturing. [^9]: Understanding NNN Agreements is essential for safeguarding your intellectual property in manufacturing. [^10]: Understanding the Manufacturing Procedure is vital for maintaining product consistency and quality.